Table of Content

Last but not least, take care of all closing costs and paperwork to seal the deal. If you’ve worked with a real estate agent or attorney, they will ensure everything is processed correctly. Overspending or overestimating what you can take on can lead you down a slippery slope. Plan ahead and figure out what your spending looks like. Determine if you need partners like a property manager, potential travel costs and any other expenses that are relevant to your goals and the property you’re investing in. You have a couple of options when it comes to your second mortgage.

However, if that’s not enough, a second home mortgage is the likely best option. If you're looking long distance and can't visit the property in person, a good agent can be your eyes and ears on the ground. Demonstrating income potential from a home that's already a rental isn't too hard, so long as the seller is willing to share that information.

Vacation Homes

Memories with our family are priceless and owning a vacation home can trigger scheduling quality time together. To me, whatever it takes to pull the family together, if you can comfortably afford it. There are wonderful places in the Southeast to consider, offering resort lifestyles or simple pleasures.

Equally, your job may take you to different parts of the country. A second home may also serve as a holiday home, or be rented out some of the time as a source of income. Alternatively, you may have a large sum of money to invest and decide to sink it into a property so you can obtain some practical use from it while it increases in value. A second home purchase may even be short-term, if you fancy making money from property developing. Furthermore, you may also be able to deduct office and business expenses. Plus, if you used a real estate agent to purchase the home, you may be able to deduct from any commission you paid.

Tips for Your Financial Well-Being

If you currently have too much debt, lenders may not risk lending with you. Most lenders consider 43% or less a reasonable DTI. If you’re using a jumbo loan, you’ll typically need to put down a minimum down payment of 20% to 25%, but sometimes 30% or more, depending on the lender. Fortunately, you can avoid paying private mortgage insurance with any down payment of 20% or more, just like you can with a conventional mortgage.

So, it's possible to exceed the 14-day limit if you stay at your property to perform a repair. Plan to document your maintenance activities by retaining receipts to prove you weren’t just vacationing on those days. Fees will also go up on certain high-balance loans with exceptions for first-time buyers.

Tax Breaks for Second-Home Owners

Payroll Payroll services and support to keep you compliant. Small Business Small business tax prep File yourself or with a small business certified tax professional. Finances Spruce A mobile banking app for people who want to be good with money. You must own the property for at least two years before selling.

However, there are steps you can take to ensure paying for a second home is part of your financial plan and budget. One of the most important is getting a strong mortgage rate so the home doesn’t become a financial burden. A home is the largest purchase of most people’s lifetimes.

A Growing Market

If you hold a second property for business or investment purposes, you might be able to defer capital gains taxes under a1031 exchange. Known as a like-kind exchange, this involves selling the property and replacing it with a similar property (both properties must be located in the U.S.). When you sell the initial property, you must identify a replacement property within 45 days and acquire it within 180 days. Capital gains are then deferred until the replacement property is sold (although it is possible to continually defer taxes with further like-kind exchanges). If the second home is considered a personal residence, you must file Form 1040 or 1040-SR and itemize deductions on Schedule A to claim the mortgage interest deduction.

That leaves you with conventional and jumbo loans to choose from. This is an optional tax refund-related loan from Pathward, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you.

If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes . If the home is considered an investment property , you can deduct expenses related to owning, maintaining, and operating the property. This means you can deduct mortgage interest and property taxes as you would with any home. You can deduct rental expenses, but only up to the level of rental income (e.g., you can't claim rental losses). The house is considered a personal residence, so you can't deduct rental-related expenses like advertising and utilities.

Depending on where you choose to purchase a second or vacation home, these monthly costs can be drastically more. Even if you didn’t start with buy-to-let in mind, you may decide to let your second home so that it generates income rather than sitting empty . However, to do this you’ll need to remortgage the secondary residence to a buy-to-let mortgage, as you can’t let a property if it’s on an ordinary homebuyer’s mortgage. When you buy any property, you have to pay stamp duty land tax on the purchase. When you buy a secondary residence, you have to pay an extra 3 per cent surcharge on top of the usual stamp duty. Unlike first home stamp duty, it includes properties under the value of £125,000.

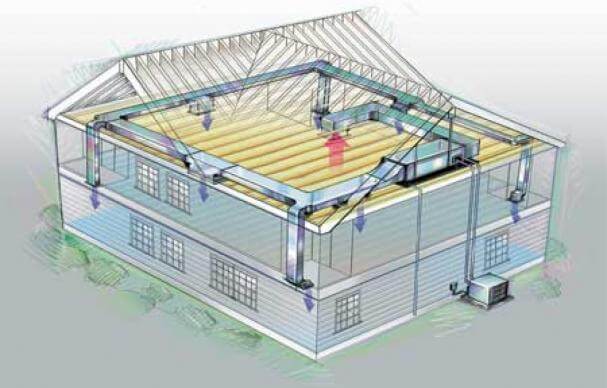

However, ductwork and piping and where the unit will be located should also be factored in. Typically, the full replacement cost will range from $15,000 to $40,000, depending on the space being cooled. If you have the skills you might be able to do it yourself, but there is a value to your time, too. And if you’re not living at your vacation home most of the year, it won’t be you. This review is the subjective opinion of a Tripadvisor member and not of Tripadvisor LLC. Tripadvisor performs checks on reviews.

No comments:

Post a Comment